Signed July 4 2025, Public Law 119-21

1. Why this matters for payroll & HR teams

OBBBA rewrites several payroll-adjacent pieces of the Internal Revenue Code effective with tax year 2025 (or first plan years that begin in 2026). It combines bigger take-home pay incentives for frontline workers with faster and more generous business write-offs and credits. Your payroll, HR, benefits and accounting systems will all need tweaks to capture the new data the IRS now expects. (IRS)

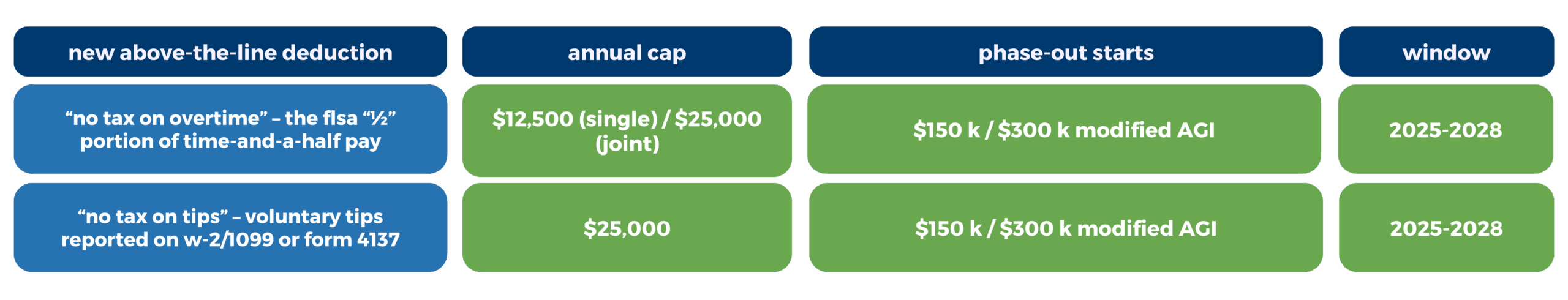

2. Two headline employee deductions you’ll have to track

Employer impact: starting with 2025 pay runs you must break out qualified overtime and cash tips on year-end statements (and, for tips, include the employee’s occupation code). Expect an updated Form W-2 layout and a brand-new IRS information return by early 2026. (IRS, Axios)

- Federal Income Tax Withholding: Employers should continue withholding federal income taxes on tips and overtime pay through the end of 2025. Workers will reconcile deductions when filing annual tax returns.

- Reporting Requirements: Starting in 2025, employers must report qualified tips, overtime pay, and workers’ occupations (for tips) on Form W-2 and Form 1099, due in January 2026.

- Transition Rule: Employers can use an IRS-approved method to estimate tips and overtime paid in 2025.

- Future Adjustments: In 2026, employers will adjust withholding for tips and overtime based on IRS future guidelines.”

3. Business-side cash-flow boosts

- Immediate expensing of U.S. R&D (IRC §174A) is back. Firms can deduct 100 % of domestic research costs incurred after 12-31-2024; small businesses (< $31 M average receipts) may amend 2022-24 returns for a catch-up refund. (KBKG)

- Section 179 limit jumps to $2.5 M with a higher $4 M phase-out threshold, and 100 % bonus depreciation is restored for most tangible assets placed in service after 1-19-2025. (KBKG)

- Interest-expense cap reverts to an EBITDA base, enlarging the 30 % limitation and giving leveraged companies extra room. (KBKG)

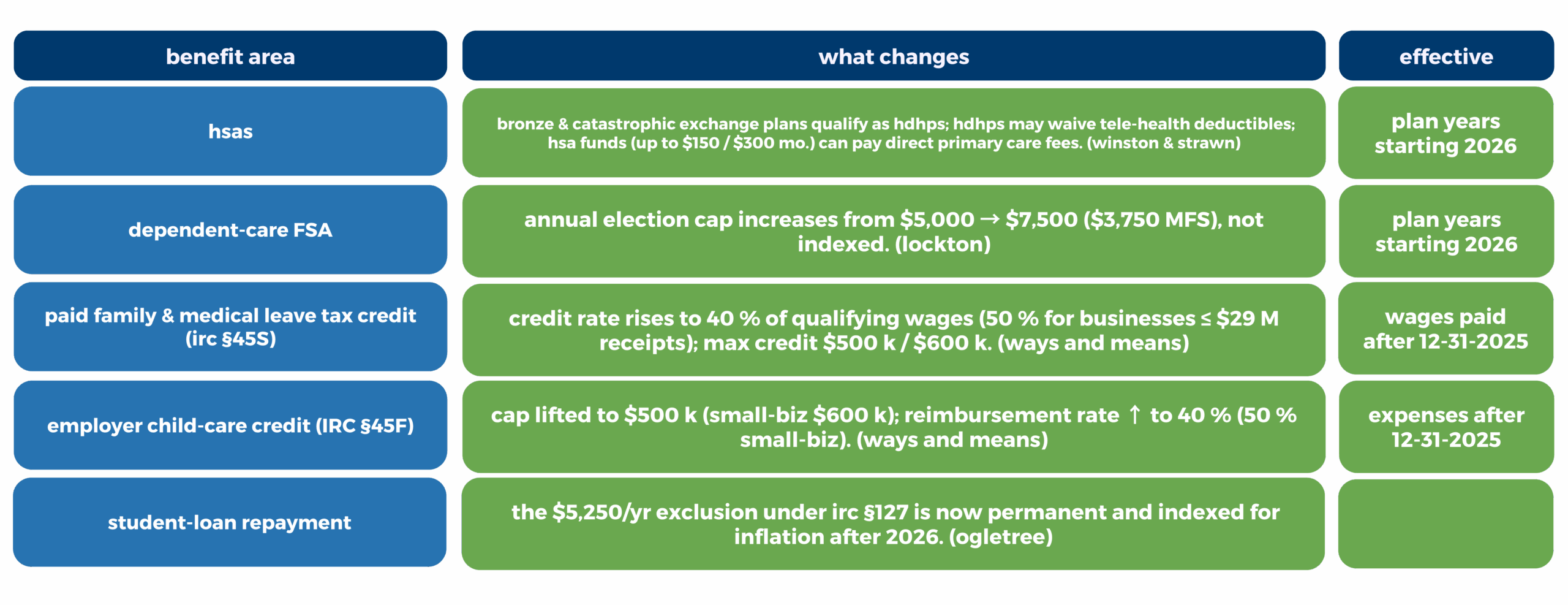

4. Health & family-benefit tweaks you’ll want in your 2026 open enrollment

Sources: Winston & Strawn, Lockton, Ways and Means, Ogletree

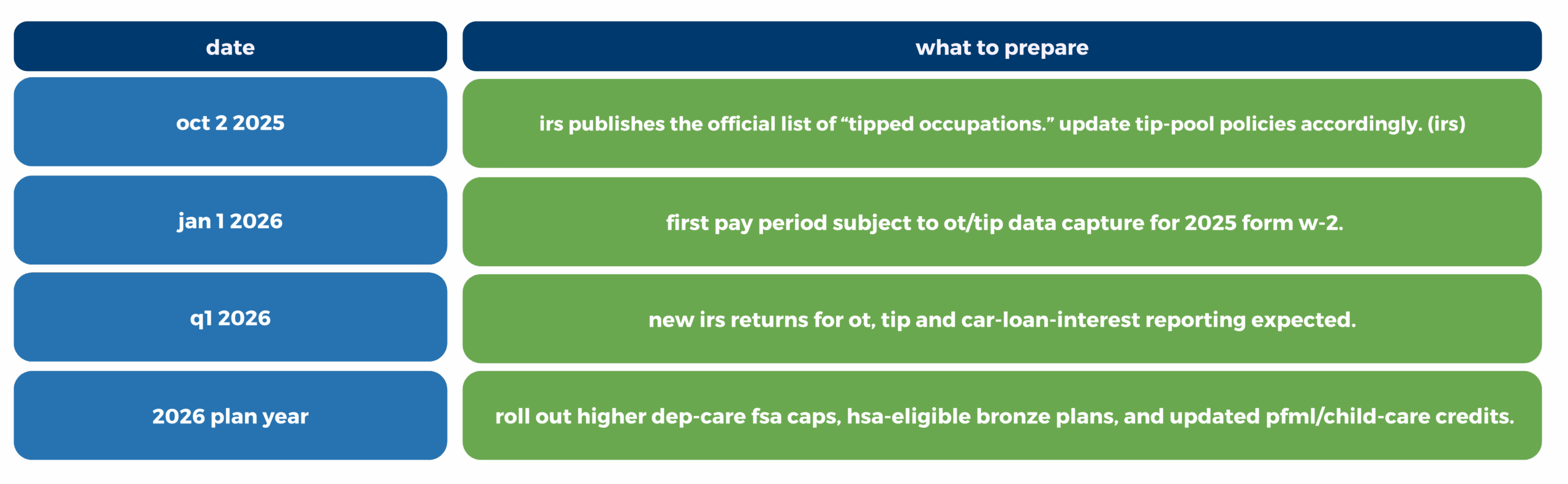

5. Compliance timeline

Source: IRS

Bottom line: OBBBA is a seize-the-moment law: workers get bigger tax deductions only if employers can supply precise payroll data, and businesses unlock immediate write-offs only if they update GL coding and benefit documents. With the right prep in 2025, you’ll turn a compliance mandate into a competitive advantage.