hr services trusted by hundreds of small businesses

Learn more-

Best Payroll Services Company

SC Best in Business | 2021

-

5

-

Best Human Resources Benefits Company

SC Best in Business | 2021

smash it

Are you looking for an HR easy button?

Are you experiencing any of these five pains related to HR?

HR is commonly called “death by 1,000 cuts” because there are so many little things. Keeping up with all the documentation from new hire to termination, understanding all the changing regulations in each state, and trying to automate your critical functions is enough to make your head spin.

guHRoo bundles all of payroll, HR, and benefits in one solution with dedicated guHRoos to help you focus on what matters.

Don’t waste your time on hold with call centers, talk to your dedicated team and get back to work.

Book a Free HR Diagnosis

- administrative burden

- lack of experience

- no automation

- lousy support

- compliance concerns

your solutions

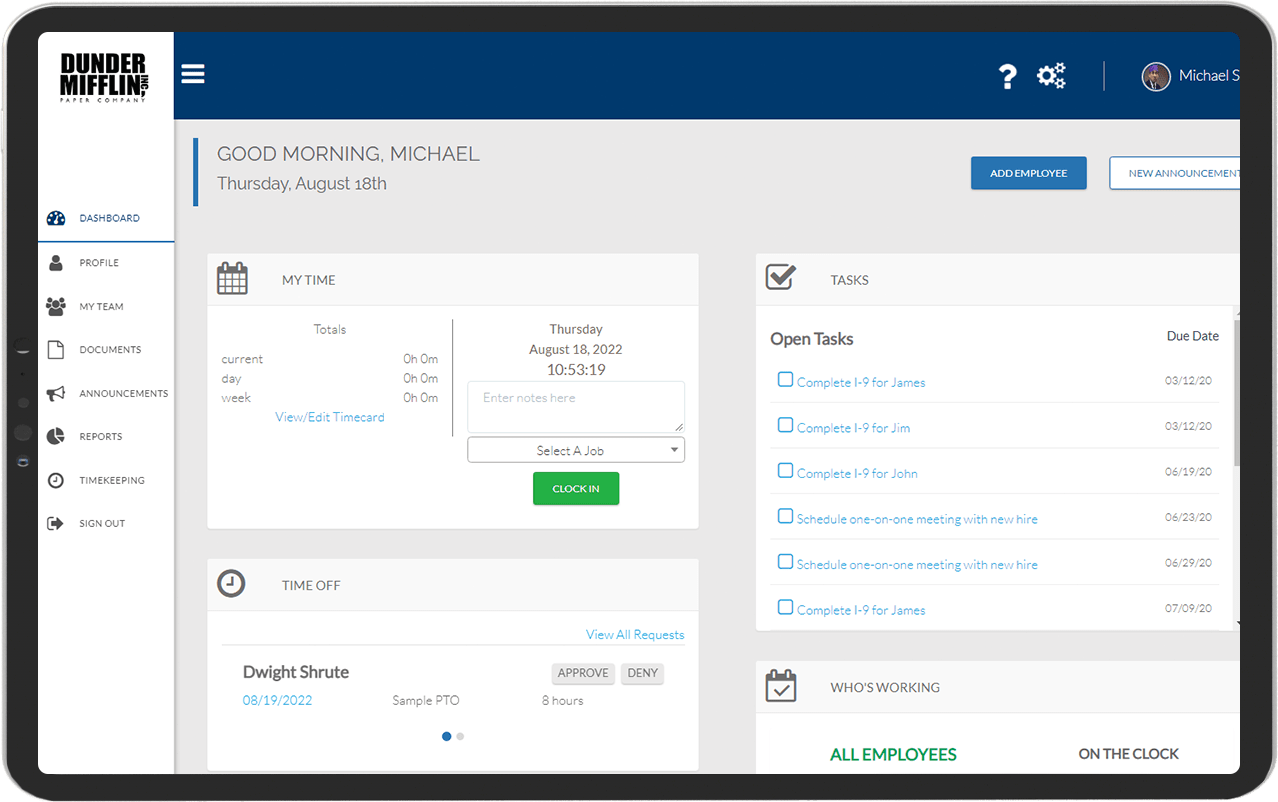

everything you need to effortlessly manage your human resources processes

-

HR Management

streamline your hr process from hire to fire

Learn MoreEmployee Benefits

get access to employee benefits at more affordable rates with group buying power.

Learn More -

Payroll

Our “high-tech” “high-touch” process ensures your payroll is simple and well-supported

Learn More Find the right solution

How it Works

hr services to transform your HR in as little as 30 days

-

Schedule a call or contact us

-

We’ll help you choose the right HR solution

-

We’ll implement it for you

Testimonials

You Said it

“All systems are easy to use and deliver a professional image to our employees at an affordable price. We anticipate saving 50% in time and cost savings.”

Pamela Cody

Rhythmlink International

“I have worked with guHRoo (formerly ERG) for almost 3 years and they have been very responsive as well as diligent in taking care of our payroll and HR needs. I would highly recommend them!”

Dr. Travis Mize

Sunset Periodontics